Developing Your Sustainable Investing Strategy

Environmental, social and governance (ESG) investing has exploded in popularity, and as of 2020, one in three dollars of professionally managed assets was in an ESG-labeled strategy1.

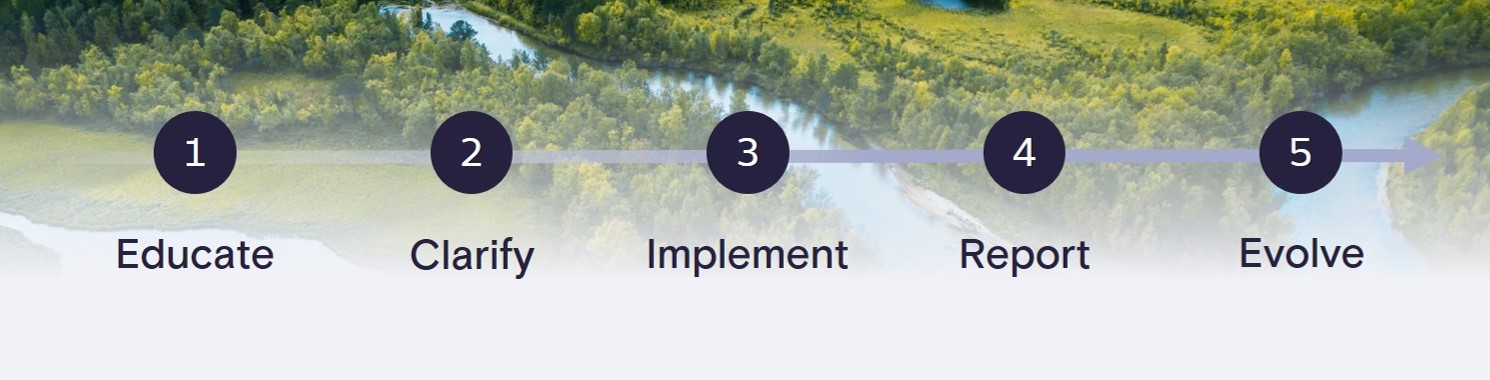

The ESG investing landscape is quickly growing in size and complexity. The new publication, Developing Your Sustainable Investing Strategy, from the PWM Sustainable Solutions Group at Goldman Sachs, outlines a five-step process you can use to navigate this ever-evolving sustainable investing landscape and establish a strategy to help you reach your long-term investment goals. The steps are as follows:

- Educate. We believe a successful sustainable investing strategy starts with a strong baseline understanding of the unique challenges and opportunities ESG and impact investing present

- Clarify. We work with our clients to define and document the ESG values most important to them and convert that value set into portfolio-level objectives

- Implement. We help each client achieve both their financial and sustainability goals through bespoke implementation; there is no “one-size-fits-all” approach to sustainable investing

- Report. We provide custom ESG portfolio analytics to show the relative impact of implementation decisions made in the portfolio

- Evolve. We perform ongoing monitoring of the portfolio to ensure values-alignment and performance objectives are met and to address any new ESG-related risks that may arise

Please contact your Goldman Sachs team for access to the full publication.

- Global Sustainable Investment Alliance (GSIA), Bloomberg Intelligence (2020).

This material is intended for educational purposes only and is provided solely on the basis that it will not constitute investment advice and will not form a primary basis for any personal or plan’s investment decisions. While it is based on information believed to be reliable, no warranty is given as to its accuracy or completeness and it should not be relied upon as such. Goldman Sachs is not a fiduciary with respect to any person or plan by reason of providing the material herein, information and opinions expressed by individuals other than Goldman Sachs employees do not necessarily reflect the view of Goldman Sachs. This material may not, without Goldman Sachs’ prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction. Investing involves risk, including the potential loss of money invested. Past performance does not guarantee future results. Neither asset diversification or investment in a continuous or periodic investment plan guarantees a profit or protects against a loss. Information and opinions provided herein are as of the date of this material only and are subject to change without notice.

© 2023 The Goldman Sachs Group, Inc. All rights reserved.

Goldman Sachs & Co. LLC is registered with the Securities and Exchange Commission (“SEC”) as both a broker-dealer and an investment adviser and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”).

© 2025 Goldman Sachs. All rights reserved.