Wealth Management Investment Strategy Group (ISG) — 2025 Outlook

Keep On Truckin'

The two key themes that have underpinned ISG's investment recommendations since the trough of the global financial crisis — US Preeminence and Stay Invested — remain intact. Connect with an advisor to learn more about these investment themes and ISG's recommendations for individual investors.

Connect with us today.

By submitting this information, you hereby authorize and request that Goldman Sachs Private Wealth Management, and its affiliates, contact you with information about their services at the telephone number and email you provided, even if you have previously requested that we not contact you for marketing purposes. In addition, you acknowledge that we will use your information as described in our Privacy Policies. If you are based in the US, we may share your information with our affiliates, including Goldman Sachs Wealth Services.

Wealth Management Investment Strategy Group (ISG) — 2025 Outlook

Keep On Truckin'

The two key themes that have underpinned ISG's investment recommendations since the trough of the global financial crisis — US Preeminence and Stay Invested — remain intact. Connect with an advisor to learn more about these investment themes and ISG's recommendations for individual investors.

Connect with us today.

By submitting this information, you hereby authorize and request that Goldman Sachs Private Wealth Management, and its affiliates, contact you with information about their services at the telephone number and email you provided, even if you have previously requested that we not contact you for marketing purposes. In addition, you acknowledge that we will use your information as described in our Privacy Policy. If you are based in the US, we may share your information with our affiliates, including Goldman Sachs Ayco.

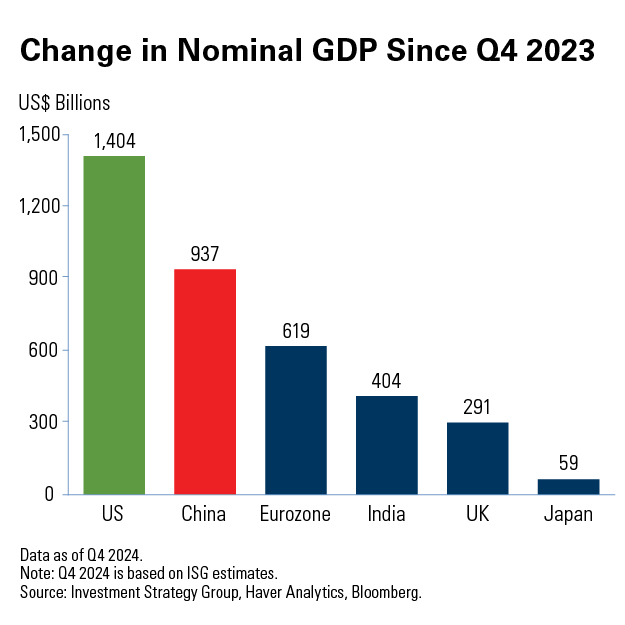

US Preeminence: The Gap Widens

The gap between the US and other developed and emerging market countries continues to widen across key economic and financial market metrics. ISG shows that no major country will catch up to the US across most of these metrics for the foreseeable future, if ever. Read more, along with ISG's views and investment recommendations in their 2025 Outlook report, Keep On Truckin'.

Watch Sharmin Mossavar-Rahmani, head of ISG and chief investment officer of Goldman Sachs Wealth Management, talk through the key themes from this year's outlook.

Illustrating US Preeminence | The Gap Widens

The cover art for our Outlook depicts how the gap between the US and other developed and emerging market countries continues to widen across key economic and financial market metrics, and no major country will catch up for the foreseeable future, if ever.

The US has been the world's largest economy since the 1890s and ISG believes it will remain so for the foreseeable future. They show the gap between the US and the rest of the world will continue to widen.

Questions From Our Clients

After such a long run of US equity outperformance, clients are asking questions about our strategic and tactical asset allocation views.

- US Equities

- Non-US Equities

- Cash or Bonds

- Gold or Bitcoin

Allocate all public equity exposure exclusively to the US?

No. While ISG recommends an overweight to US equities, they do not recommend a zero allocation to non-US equities. ISG does not expect US equities to outperform by the same magnitude we have seen over the last 15 years, and many world-class companies are located outside the US and are attractively valued.

Wealth Management Investment Strategy Group

This material represents the views of the Wealth Management Investment Strategy Group and is not a product of Goldman Sachs Global Investment Research (GIR). It is not research and is not intended as such. The views and opinions expressed by ISG may differ from those expressed by GIR, LP, or other departments or businesses of Goldman Sachs. Past performance is not indicative of future results which may vary.

This material has been approved for issue in the United Kingdom solely for the purposes of Section 21 of the Financial Services and Markets Act 2000 by GSI, Plumtree Court, 25 Shoe Lane, London, EC4A 4AU, United Kingdom; authorised by the Prudential Regulation Authority; and regulated by the Financial Conduct Authority and the Prudential Regulation Authority; by Goldman Sachs Canada, in connection with its distribution in Canada; in the United States by Goldman Sachs & Co. LLC Member FINRA/SIPC; in Hong Kong by Goldman Sachs (Asia) L.L.C.; in Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in Japan by Goldman Sachs (Japan) Ltd; in Australia by Goldman Sachs Australia Pty Limited (ACN 092 589 770); in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198502165W); in Dubai by Goldman Sachs International, in Germany by Goldman Sachs Bank Europe SE; in Switzerland by Goldman Sachs Bank AG; in Spain by Goldman Sachs Bank Europe SE, Sucursal en España; in Italy by Goldman Sachs Bank Europe SE, Succursale Italia; and in France by Goldman Sachs Bank Europe SE Succursale de Paris.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient, without Goldman Sachs' prior written consent. This does not constitute an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. This material is a solicitation of derivatives business generally, only for the purposes of, and to the extent it would otherwise be subject to, §§ 1.71 and 23.605 of the U.S. Commodity Exchange Act.

Goldman Sachs & Co. LLC is registered with the Securities and Exchange Commission (“SEC”) as both a broker-dealer and an investment adviser and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”).

© 2025 Goldman Sachs. All rights reserved.