Strategic Asset Allocation in the Face of Uncertainty

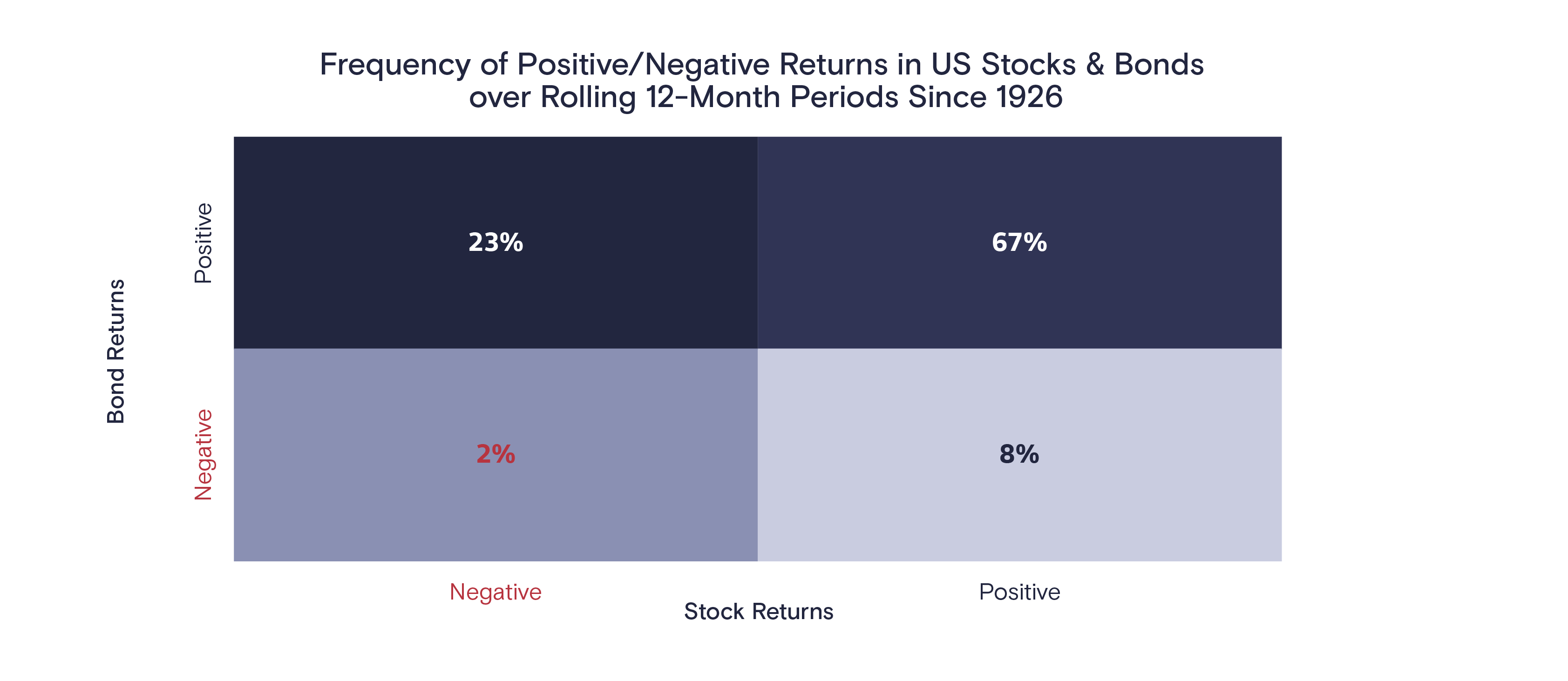

Last year, something remarkably rare happened in the markets: both stocks and bonds saw negative returns. This simultaneous decline has occurred in only 2% of rolling 12-month periods since 1926.

This caused several institutions to question the viability of 60/40 stock/bond portfolios. As an aside, please note the term “60/40 stock/bond portfolio” is a generic finance term for a portfolio of stocks and bonds and doesn’t imply 60/40 is the right mix for every investor.

However, our Investment Strategy Group (ISG) pointed out in their 2023 Outlook, Caution: Heavy Fog, that investors should think twice before altering their strategic allocation.

"When allocating assets amid numerous unknowns, it is best not to react to market noise or adjust portfolios based on a rare market occurrence," head of ISG and chief investment officer Sharmin Mossavar-Rahmani said. "Portfolios are designed to ride out volatility and provide staying power in the event of geopolitical disruptions."

ISG noted portfolio returns tend to be above average in years following losses in both stocks and bonds, gaining 10.2% in the following year and nearly 22% over a two-year span.

Breaking down average yearly performance of stocks and bonds, we see that:

- 67% of the time, both asset classes provided positive returns.

- 23% of the time, stocks had a negative return partially offset by positive bond returns.

- 8% of the time, stocks had a positive return partially offset by negative bond returns.

Investment Strategy Group (“ISG”). The Investment Strategy Group, part of the Asset & Wealth Management business (“AWM”) of GS, focuses on asset allocation strategy formation and market analysis for GS Wealth Management. Any information that references ISG, including their model portfolios, represents the views of ISG, is not financial research and is not a product of GS Global Investment Research and may vary significantly from views expressed by individual portfolio management teams within AWM, or other groups at GS.

This material is intended for educational purposes only and is provided solely on the basis that it will not constitute investment advice and will not form a primary basis for any personal or plan’s investment decisions. While it is based on information believed to be reliable, no warranty is given as to its accuracy or completeness and it should not be relied upon as such. Goldman Sachs is not a fiduciary with respect to any person or plan by reason of providing the material herein, information and opinions expressed by individuals other than Goldman Sachs employees do not necessarily reflect the view of Goldman Sachs. This material may not, without Goldman Sachs’ prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction. Investing involves risk, including the potential loss of money invested. Past performance does not guarantee future results. Neither asset diversification or investment in a continuous or periodic investment plan guarantees a profit or protects against a loss. Information and opinions provided herein are as of the date of this material only and are subject to change without notice.

© 2023 The Goldman Sachs Group, Inc. All rights reserved.

Goldman Sachs & Co. LLC is registered with the Securities and Exchange Commission (“SEC”) as both a broker-dealer and an investment adviser and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”).

© 2025 Goldman Sachs. All rights reserved.