529 Plans – Qualified Tuition Programs

529 Plans – Qualified Tuition Programs

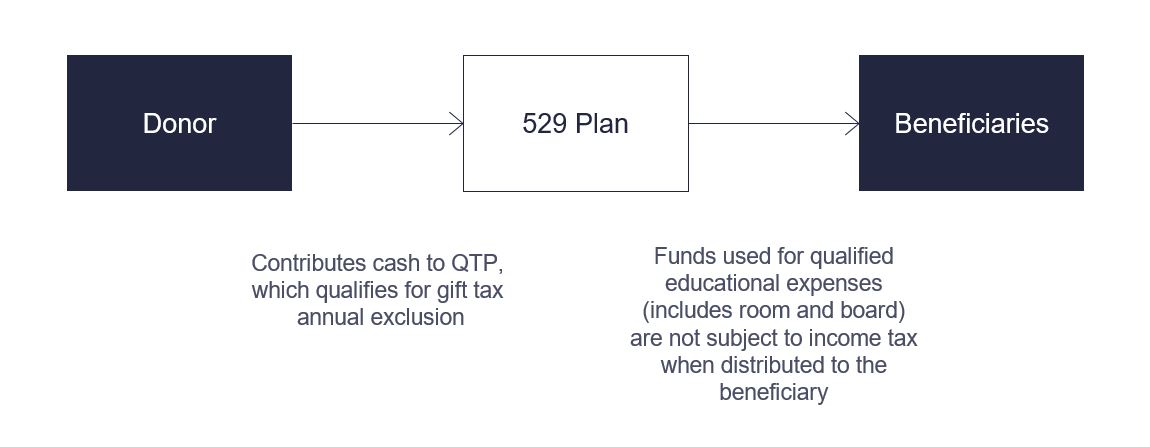

Qualified Tuition Programs (QTPs) allow individuals to contribute to an account that will pay certain elementary, secondary and higher education expenses for a designated beneficiary. The assets in the account can accumulate federal income tax-free and are not subject to federal income tax upon withdrawal if used to pay for qualified educational expenses of the designated beneficiary.

Advantages

● Contributions to accounts accumulate free of federal income tax and state income tax in states that define income under the federal income tax rules or otherwise provide for exemption

● In certain states, the donor can obtain a state income tax deduction for the contribution

● Upon withdrawal, if funds are used to pay for higher educational expenses or up to $10,000 per year in elementary or secondary school expenses, the beneficiary will not be subject to federal income tax on the earnings in the account

● An account can be established for anyone as long as the beneficiary will potentially attend a primary or secondary school or college; it is not limited to the children of the donor

● Easy to establish and operate

● The income earned in an account is not subject to current federal income tax (ordinary or capital gains) while the account is held in the plan

● Proceeds can be used for tuition (i) of up to $10,000 per year at any public, private or religious primary or secondary school and (ii) at any accredited two or four year public or private college or university regardless of the state in which the plan is established. Also, most states allow for the payment of room and board, books, supplies, and equipment from the proceeds

● Revocable by the account owner (subject to income tax and 10% penalty)

● Contributions qualify for the gift tax annual exclusion and Generation Skipping Transfer (GST) tax exemption, and despite ownership by donor, the account is not subject to estate tax at the donor’s death

● No ceiling on income levels for participation

● Donors can pre-fund up to 5 years of annual exclusion gifts ($75,000 in 2021)

● Account owner can rollover to another account or change investment options once every 12 months which provides some level of indirect control of investments

● Not required to establish plan in donor or beneficiary's state of residence but may offer state tax benefits

Considerations

● Account balances may be withdrawn by the donor for non-educational purposes, but any accumulated investment earnings will then be subject to income taxes and a penalty of 10%

● Once funds are contributed, the QTP has complete discretion over how the funds are invested and the donor gives up all control; however, the donor can change plans once every 12 months. States vary their investment strategies for funds within particular accounts based on the time horizon to expected distributions

● Only cash can be contributed to a QTP; gifts of other assets are not accepted

● For state tax purposes, many states may not respect QTPs established and maintained in another state and may charge their own residents with income taxes on earnings accumulated within another state’s QTP or on earnings that are rolled-over to another state’s QTP. Accordingly, donors should carefully consider their own circumstances and consult with their tax advisors as to which state’s QTP is most beneficial for them

● Contributions can only be made in cash

● The state determines the investment options, timing of investment decisions, and investment advisors

● Earnings (including capital gains) not used for qualified education expenses are subject to federal income tax under annuity rules plus a 10% penalty

● For state tax purposes, many states may not respect QTPs established and maintained in another state and may charge their own residents with income taxes on earnings accumulated within another state’s QTP or on earnings that are rolled-over to another state’s QTP. Accordingly, donors should carefully consider their own circumstances and consult with their tax advisors as to which state’s QTP is most beneficial for them

● Contributions require use of gift tax annual exclusion when the donor could make unlimited gifts of tuition free of gift tax

● Each state sets limits on maximum contributions

The Goldman Sachs Family Office

Thank you for reviewing this presentation. Please review the important information below.

Scope of Relationship and Service Providers. Goldman Sachs & Co. LLC. (GS&Co., a subsidiary of The Goldman Sachs Group, Inc. and a registered investment adviser) and its present and future affiliates and their respective partners, officers, directors, employees, and agents (collectively “GS”), may offer and provide through the GS Family Office (“GSFO”)—or through a client referral to third parties—a suite of personal family office services (“GSFO Services”) specifically designed for certain Private Wealth Management clients of GS. GS may receive fees for certain GSFO Services. This material represents the views of GSFO and the views and opinions expressed herein may differ from the views and opinions expressed by other departments or divisions of GS.

GS does not provide legal, tax, or accounting advice to its clients, unless explicitly agreed between the client and GS, and GSFO does not offer the sale of insurance products. As part of its GSFO Services, GSFO may, upon your request, discuss with you various aspects of financial planning. The scope of such planning services will vary among clients and may only include episodic and educational consultations that should not be viewed as tax advice. Financial planning does not address every aspect of a client’s financial life and the fact that a topic is not discussed with you does not indicate that the topic is not applicable to your financial situation. GSFO may review with you the general income tax consequences of your investments, estate planning, philanthropic endeavors, real estate holdings, and certain other activities that may affect your income tax.

GS assumes no duty to take action pursuant to any recommendations, advice, or financial planning strategies discussed with you as part of GSFO Services. It is your responsibility to determine if and how any such recommendations, advice, or financial planning strategies should be implemented or otherwise followed, and you are encouraged to consult with your own tax advisor and other professionals regarding your specific circumstances. GS is not liable for any services received from your independent advisors or the results of any incident arising from any such services or advice.

Certain of the GSFO Services may be provided by GS, which includes, among others, GS wealth management personnel (“GS Personnel”), The Ayco Company, L.P. (“Ayco”) (a GS affiliate and a wholly-owned subsidiary of The Goldman Sachs Group, Inc.), and Ayco wealth management personnel (“Ayco Personnel”). Certain other of the GSFO Services may be provided through a client referral to subcontractors, independent service providers, or other unaffiliated third parties (collectively, “Third Party Vendors” or “Network Service Providers”), who are not acting as financial or investment advisors, and who are not delivering investment or financial advice, with respect to the provision of GSFO Services. Services provided by Third Party Vendors are wholly independent of those provided by GS and additional terms of service may apply for clients entering into any separate agreements with Third Party Vendors in furtherance of GSFO Services. GS may refer clients to Third Party Vendors for services including, but not limited to, tax return preparation, household payment administration and bill payment, certain philanthropic advisory services, cyber security services, physical security services, and health advisory services.

The scope, duration, deliverables, assigned personnel, referrals to Third Party Vendors, and delivery channels through which GSFO Services are provided will vary among clients, including the facts, requested services, circumstances, personal financial goals, net worth, complexity, and/or needs of each client. Services will be reviewed, advised upon, and/or performed, to the extent applicable to each client. GSFO Services will be provided based on individual client needs. Not all clients will receive all services. Certain activities may fall beyond the scope of the GSFO Services. In addition, GSFO Services may not address every aspect of a client’s financial life.

GSFO Services do not include investment and brokerage services for clients’ GS accounts, which will continue to be provided by GS pursuant to the terms of the agreements between those clients and GS. Any asset management services provided are governed by a separate investment management agreement (as may be applicable). GS Personnel and Ayco Personnel providing GSFO Services do not provide discretionary management over client investments.

Consolidated Reporting. Any consolidated report that GSFO may provide is at your request and is for informational purposes only; it is not your official statement. Information (including valuation) regarding holdings in third party accounts or other non-GS investments may be included as a courtesy and is based on information provided by you. GS does not perform review or diligence on, independently verify the accuracy of information regarding, or provide advice on such non-GS investments; GS assumes no responsibility for the accuracy of the source information and such assets may not be included on GS’s books and records. While we may inform you of how a non-GS investment fits within your overall asset allocation, our classification of the investment may be different than your custodian or external adviser’s classification. You should review and maintain the original source documents (including third party financial statements) and review them for any notices or relevant disclosures. Assets held away may not be covered by SIPC.

Responsibility to Clients. GS may act as a fiduciary in providing some but not all GSFO Services provided by GS. GS may act in an investment advisory capacity with respect to one or more client accounts and may undertake a fiduciary duty when providing certain of the GSFO Services. Where GS acts as a broker it may not become a fiduciary. GS does not act in an investment advisory capacity and has no fiduciary duty when providing certain GSFO Services, including accommodation services – which are provided as a courtesy only. In providing GSFO Services, GS will rely on information provided by, or on behalf of, clients. GS will not be responsible for the accuracy or completeness of any such information, nor for any consequences related to the use of any inaccurate or incomplete information.

Limitation of Liability for Certain Services. Where GS refers clients to Third Party Vendors for certain GSFO Services, GS is not liable for clients’ ultimate selection and utilization of such Third Party Vendor, for any services rendered or guidance received, or the results of any incident arising from any such referral. GS is not responsible for the supervision, monitoring, management, or performance of such Third Party Vendors and is not liable for any failure of Third Party Vendors to render services or any losses incurred as a result of such services. Cybersecurity and physical security consultations provided by GS are intended to provide a general overview of cyber and physical security threats, but are not comprehensive; GS is not liable for any incident following such consultations. Where GSFO provides art advisory services, such services are generally limited to education; GS does not recommend purchasing art or collectibles as an investment strategy, provide formal or informal appraisals of the value of, or opine on the future investment potential of, any specific artwork or collectible.

Fee Structure. Fees for GSFO Services may vary among clients depending on their particular circumstances. Certain of the fees associated with GSFO Services are either charged as a single bundled fee while other fees are charged as supplemental fees, which are identified in the GSFO Services Supplement to clients’ Customer Agreement. GS reserves the right to adjust the GSFO Services fees in the event of extraordinary circumstances.

Conflicts. GS may receive fees for certain of the GSFO Services. In the course of providing such services, GS may offer additional services and/or products that are independent of the GSFO Services and for which additional fees or commissions are charged. These offerings create a conflict of interest and clients may be asked to acknowledge their understanding of such conflict.

Assumptions. Where materials and/or analyses are provided to you, they are based on the assumptions stated therein. In the event any of the assumptions used do not prove to be true, results are likely to vary substantially from the examples shown herein. These examples are for illustrative purposes only and no representation is being made that any client will or is likely to achieve the results shown. Assumed growth rates are subject to high levels of uncertainty and do not represent actual trading and, thus, may not reflect material economic and market factors that may have an impact on actual performance. GS has no obligation to provide updates to these rates.

Any provided financial planning services, including cash flow analyses based on the information you provide, are a hypothetical illustration of mathematical principles and are not a prediction or projection of performance of an investment or investment strategy.

No Distribution; No Offer or Solicitation. This material may not, without GS‘s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation.

GSFO services offered through Goldman Sachs and Co. LLC. Member FINRA/SIPC.

This material is intended for educational purposes only and is provided solely on the basis that it will not constitute investment advice and will not form a primary basis for any personal or plan’s investment decisions. While it is based on information believed to be reliable, no warranty is given as to its accuracy or completeness and it should not be relied upon as such. Goldman Sachs is not a fiduciary with respect to any person or plan by reason of providing the material herein, information and opinions expressed by individuals other than Goldman Sachs employees do not necessarily reflect the view of Goldman Sachs. This material may not, without Goldman Sachs’ prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction. Investing involves risk, including the potential loss of money invested. Past performance does not guarantee future results. Neither asset diversification or investment in a continuous or periodic investment plan guarantees a profit or protects against a loss. Information and opinions provided herein are as of the date of this material only and are subject to change without notice.

© 2023 The Goldman Sachs Group, Inc. All rights reserved.

Goldman Sachs & Co. LLC is registered with the Securities and Exchange Commission (“SEC”) as both a broker-dealer and an investment adviser and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”)